For the month of June 2021, Canada posted a trade balance surplus of $3.2 billion. This result was not at all expected by forecasters, who pinned a shortfall of -$0.6 billion. Imports fell only -1.0% in June to $50.5 billion while exports climbed by a surprising 8.7%; this spike represents a new record for total exports in Canada, totalling $53.8 billion.¹

June’s numbers reveal the perpetuation of an odd balance, seeing Canada at a deficit with most of the world but a sustained surplus with the US. With the rest of the world, Canada faced a slightly lower deficit of $5.1 billion; with the USA, the surplus widened from $5.9 billion in May to $8.3 billion in June. This is the largest surplus Canada has held with the USA since 2008.¹

This trade balance update reflects on Statcan data pertaining to June 2021; reports are generally released 35 days following month end.

Survey: Key June Sectors in Imports and Exports

Exports were up across the board in June as 9 of the 11 product categories registered higher trade activity.¹

Of these categories, energy products did much of the heavy lifting: exports of energy products increased sharply to $11.3 billion (+22.9%) in June, the highest level since March 2019. This comes from increased volume following a slowdown in Alberta crude oil production in May and June. Exports of refined petroleum energy products (+37.1%) and natural gas (+23.3%) also increased in June.¹

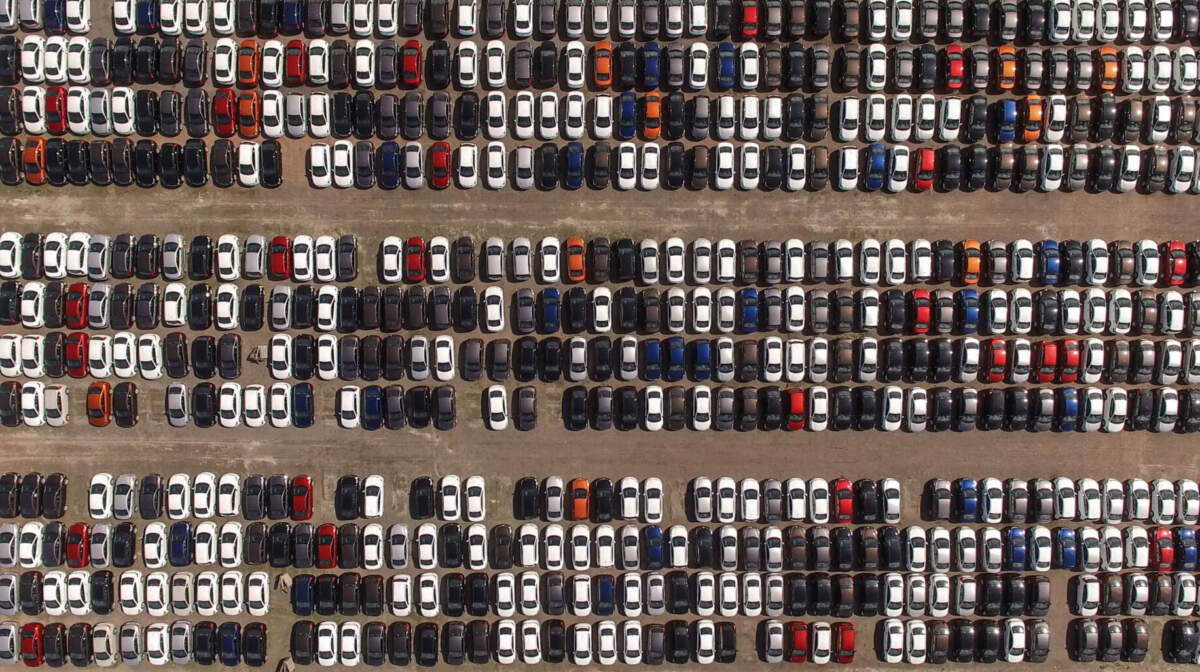

In addition, exports of passenger vehicles and parts were up in June. Fewer work stoppages and waning supply chain prompted the increase of 14.9%, but industry exports remain 8% lower than pre-pandemic levels, signalling that while the semiconductor chip shortage may now feel like old news, Canada’s auto industry has yet to recover even from the impact of COVID-19.¹

Lastly in exports, metal and non-metallic mineral products broke another record, increasing 12.7% in June to $6.7 billion. The driving force behind this increase were exports of unwrought gold, silver, and platinum group metals, and their alloys, to Hong Kong and the United Kingdom.¹

Meanwhile, imports fell in 7 of the 11 product categories. The decline was caused mostly by a drop in consumer imports, including categories which encompass personal protective equipment, articles of precious metals, clothing, and footwear. Further, imports of motor vehicles and parts fell by 3.8% in June. Here the results of supply chain difficulties are made plain: in the second quarter of 2021, imports of passenger cars and light trucks decreased 24.4%.¹

This decline was offset by higher imports of pharmaceutical and medicinal products (+24.5%), which reached a record high in June. This category was driven by higher imports of “vaccines for human medicine other than for influenza,” which rose 74.5% to $745 million—a value 21 times higher than June 2020.¹

Climate Change Takes Its Toll on Supply Chain

One might consider Western Canada’s recent “heat dome” a serious hurdle for third party logistics in Canada. But at this rate, following the shipping container shortage, port congestion, the shortage of Metro Vancouver warehousing space, and the Ever Given debacle, losing access to CN Railways due to massive heat stress now just feels like another day at the office.²

“We’ve seen how climate change can impact supply chains in the winter time,” says William McKinnon, President of Canadian Alliance. “We’re used to hearing about tracks frozen over. Now, we’re learning to work with the opposite extreme: sustained and damaging heat and uncontrollable forest fires.”³

These extreme conditions will have far reaching consequences in logistics.

“We are already seeing the impacts these disruptions have on the supply chain,” says McKinnon. “Combining these recent delays of both imports and exports with congestion on the TransPacific route, we should expect to see both selective unavailability of goods and an increase in consumer prices in the coming months.”³

If it sounds like we’re headed for a firestorm of inflation, that’s because we may be.

“Companies simply cannot shoulder the increased costs they’re facing across the board,” says McKinnon. “Ships sometimes wait two weeks to get into port; goods that would travel by rail are instead offloaded in Seattle and trucked to Ontario—this can double inbound costs. These alternatives are costly. There’s no way around it.”³

One potential outcome? Supply chain unaffordability may drive greater interest in domestic production and may force Asia to find new ways to remain competitive in North American markets.

“There are clear lessons to be learned here,” says McKinnon. “Unfortunately, consumers will likely bear the cost of that learning.”³

USMCA in Dispute As US Makes Strict Interpretation

Yet another blow to Canada’s auto industry has materialized as Mexico (with whom Canada shares a position) and the US failed to reconcile an auto trade dispute under the USMCA.

The rules of the USMCA increased the threshold of auto parts that must be produced within the partner nations to meet the requirements for duty-free trade. Under NAFTA, this threshold was 62.5%; under USMCA, it’s 75%.⁴

If a core part meets this 75% threshold (qualifying for duty-free treatment), Canada and Mexico argue that under the USMCA, they are able to round up to 100% to help meet the threshold of a broader requirement for the car’s overall regional content. The US disagrees, making it more difficult to meet the duty-free trade requirements.⁴

“This readjustment period will be interesting to observe,” says McKinnon, “as these auto companies will always do what is best for their production. If the US makes it more challenging to trade duty-free, we may see domestic production scale up.”³

“We’ve already seen this with Toyota, who have opted to build their Lexus NX350 in Cambridge, Ontario rather than Japan,” says McKinnon.³

“Regulatory issues like this may cause Canada to lose business with the Ford or General Motors milieu, but over time, we will see a redistribution,” adds McKinnon.³

As such, we can add auto parts and passenger automobiles to the growing list of consumer goods that may see increased production within Canada’s borders. With such pressure on global supply chains, it may indeed be best to move what matters closer to home.

Citations

1 Government of Canada, Statistics Canada. “The Daily — Canadian International Merchandise Trade, June 2021,” August 5, 2021. https://www150.statcan.gc.ca/n1/daily-quotidien/210805/dq210805a-eng.htm.

2 Marcy Nicholson and Natalie Obiko Pearson. “Western Fires Halt Hundreds of Canada Rail Cars, Slowing Exports,” Bloomberg. Accessed July 28, 2021. https://www.bloomberg.com/news/articles/2021-07-06/fires-snarl-west-coast-exports-as-track-damage-halts-rail-cars

3 Personal communication between William McKinnon and Rose Agency, July 2021.

4 BloombergQuint. “U.S. Clashes With Mexico, Canada on Car Rules in USMCA Risk.” Accessed July 28, 2021. https://www.bloombergquint.com/business/u-s-clashes-with-mexico-canada-on-car-rules-in-risk-to-usmca.